In the rapidly evolving world of financial technology, artificial intelligence (AI) has become a cornerstone for innovation. Among the latest breakthroughs is Fin-R1, a cutting-edge financial reasoning model developed by Shanghai University of Finance and Economics in collaboration with Caiyue Xingchen. But what makes Fin-R1 stand out in the crowded landscape of AI models? How does it address the unique challenges of the financial sector? And why should businesses and individuals alike pay attention to this groundbreaking technology?

What is Fin-R1 and Why Does It Matter?

Fin-R1 is a lightweight, high-performance reasoning model specifically designed for the financial industry. With only 7 billion parameters, it achieves performance comparable to industry giants like DeepSeek-R1, which boasts 671 billion parameters. Fin-R1 achieves an average score of 75.2 in authoritative evaluations, just 3 points behind DeepSeek-R1’s full version and significantly outperforming the 70-billion-parameter DeepSeek-R1-Distill-Llama-70B, which scored 69.2. This remarkable efficiency is achieved through innovative data construction and training frameworks, making Fin-R1 a game-changer for financial institutions and professionals.

Key Features of Fin-R1

Fin-R1’s standout features include its ability to handle complex financial tasks such as numerical reasoning on financial tables (FinQA) and multi-turn interactions (ConvFinQA). Its two-stage training process—combining supervised fine-tuning (SFT) and reinforcement learning (RL)—ensures both stability and high-quality decision-making. Additionally, Fin-R1’s open-source nature and low deployment costs make it accessible to a wide range of users, from large banks to small businesses.

Applications of Fin-R1 in the Financial Sector

Fin-R1’s versatility allows it to be applied across various domains within the financial industry. Here are some of the most impactful use cases:

Banking and Wealth Management

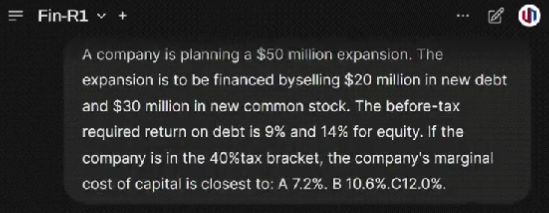

In banking, Fin-R1 can accurately calculate loan interest rates and optimize wealth management strategies. Its ability to process large datasets and generate actionable insights makes it an invaluable tool for financial advisors and portfolio managers.

Securities and Fund Management

For securities and fund management, Fin-R1 assists in generating quantitative trading codes and making asset allocation decisions. Its advanced reasoning capabilities ensure that these decisions are both data-driven and contextually aware.

Insurance and Risk Assessment

In the insurance sector, Fin-R1 evaluates policy returns and predicts market trends. Its ability to analyze complex datasets helps insurers make informed decisions, reducing risk and improving profitability.

How Fin-R1 Enhances Financial Security and Compliance

One of the most critical applications of Fin-R1 is in financial security and compliance. The model can monitor transactions in real-time, identifying anomalies and potential fraud. Additionally, it generates ESG (Environmental, Social, and Governance) reports that comply with GRI (Global Reporting Initiative) standards, ensuring that businesses meet regulatory requirements.

Case Study: Real-Time Transaction Monitoring

A leading bank implemented Fin-R1 to enhance its transaction monitoring system. By leveraging the model’s real-time analysis capabilities, the bank was able to detect fraudulent activities 30% faster than with its previous system. This not only improved security but also saved the bank millions in potential losses.

Future Trends and Insights in Financial AI

As AI continues to evolve, models like Fin-R1 are setting new standards for performance and efficiency. Future trends indicate a shift towards even more lightweight models that can deliver high performance without the need for extensive computational resources. Fin-R1 is at the forefront of this trend, paving the way for more accessible and scalable AI solutions in the financial sector.

The Role of Proxies in Enhancing AI Performance

While Fin-R1 itself is a standalone solution, its performance can be further enhanced by integrating it with advanced proxy services. For instance, using a スタティック・レジデンシャル・プロキシ can ensure that Fin-R1 accessing financial data without interruptions, maintaining consistent performance, while a ローテーション・レジデンシャル・プロキシ can provide diverse IP addresses for large-scale data scraping, which also is useful for accessing sensitive financial data, protecting against potential cyber threats. Additionally, a データセンタープロキシ can offer high-speed connections for real-time data processing, making it an ideal complement to Fin-R1’s capabilities.

Conclusion: Why Fin-R1 is a Must-Have for Financial Professionals

Fin-R1 represents a significant leap forward in financial AI, offering unparalleled performance, versatility, and accessibility. Its lightweight design, combined with its advanced reasoning capabilities, makes it an essential tool for anyone in the financial sector. Whether you’re a large institution or a small business, Fin-R1 can help you stay ahead of the curve in an increasingly competitive landscape.

Ready to revolutionize your financial operations? Learn more about Fin-R1 AI and discover how it can transform your business.